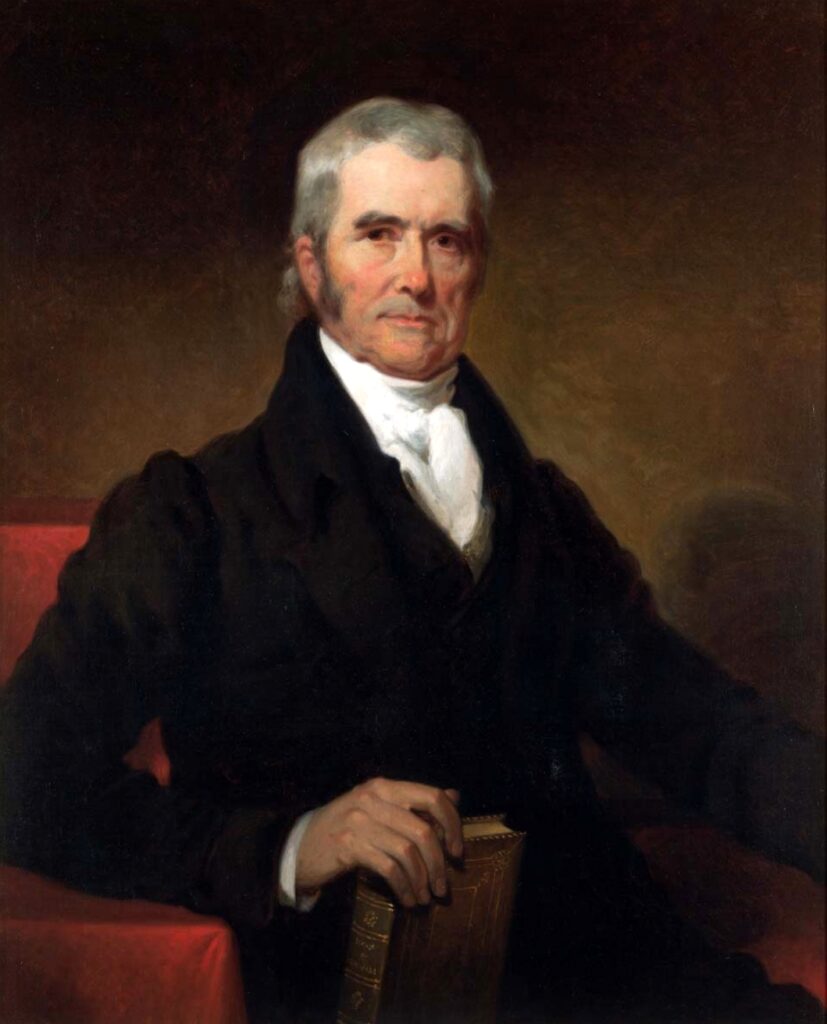

U.S. Supreme Court Chief Justice John C. Marshall (1755-1835) renders the Court’s decision in McCulloch vs. Maryland, declaring that the federal government has the right to create a national bank and no state has the power to tax the federal government. It is one of the largest expansions of federal power in the U.S. In 1816, the U.S. Congress creates the Second National Bank. The State of Maryland passes a law that taxes all banks not chartered by the state. In response, a clerk of the Baltimore branch of the National Bank, James W. McCulloch, refuses to pay taxes to Maryland. The state brings suit to collect its taxes but the Supreme Court decides in favor of the federal government with an implied “elastic” power in the Constitution. McCulloch, a wheat farmer in Catonsville, loses his property due to the court case. Chief Justice Marshall amplifies the argument against Maryland by stating that “the power to tax is the power to destroy.” In 1833, President Andrew Jackson discontinues the Second National Bank, initiating a proliferation of unchartered banks and an era of wavering financial insecurity resulting in the bank panic of 1837.

Maryland passes a new constitution that outlaws slavery 3 months before the 13th Amendment.

Maryland unionists pass a new state constitution in 1864 that outlaws slavery and disenfranchises Confederate sympathizers